Property & Casualty

Commitment to Excellence

For nearly 40 years, TCSIG has steadfastly provided member districts with top-tier property and liability solutions. Our enduring dedication has seen us evolve our Memorandum of Coverage (MOC) to provide comprehensive terms at unbeatable prices, ensuring support when it's needed most. We've consistently broadened our MOC language and refrained from imposing liability deductibles. Unlike many others, we extend our coverage to booster clubs and always seek to adapt and stay relevant in the face of ever-changing risks.

Why Choose TCSIG?

- Historical Excellence: We've weathered the challenges brought by catastrophic losses from events like wildfires and hurricanes.

- Adaptability: We're proactive, adjusting to emerging risks such as A.B. 218 and the implications of COVID-19.

- Industry Leader: As the "diamond in the rough" JPA, our best-in-class risk management practices have achieved the lowest property and liability loss ratios among California's JPAs.

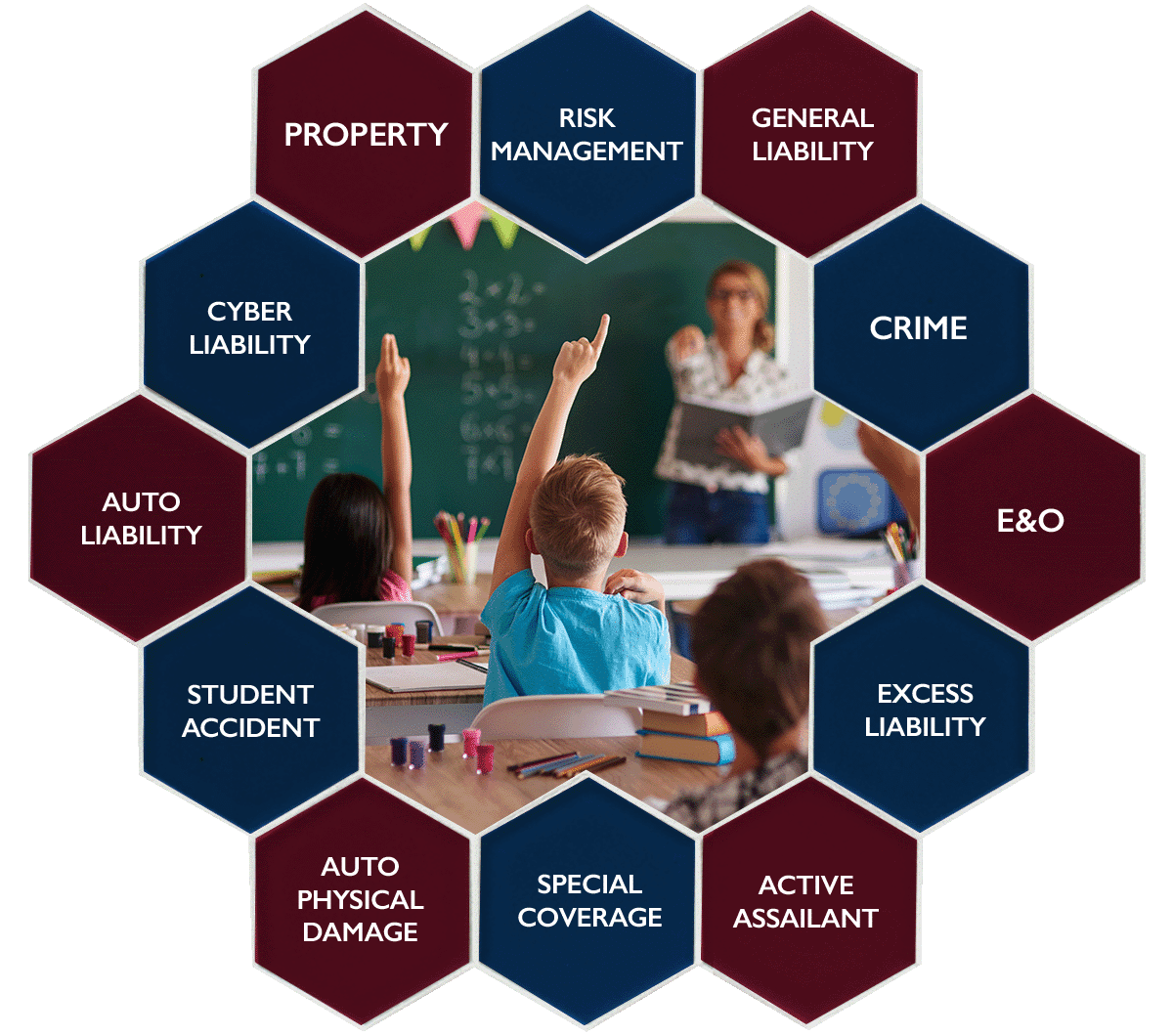

Comprehensive Coverage

Our commitment extends beyond just words. The broad coverages under the TCSIG Insurance Programs are testament to our dedication. Specifically:

- No COVID-19 Exclusions: Our Liability Program is robust, covering potential claims related to COVID-19. Whether it's activities this summer or the upcoming fall session, we've got you covered.

- No Individual District Deductibles: Our Liability coverage is all-encompassing, ensuring districts remain protected without the worry of deductibles.